- TURBOTAX HOME AND BUSINESS 2016 PRICE FOR FREE

- TURBOTAX HOME AND BUSINESS 2016 PRICE SOFTWARE

- TURBOTAX HOME AND BUSINESS 2016 PRICE FREE

TurboTax live help is limited to upper price ranges. H&R Block prices are $0 to $87 with more features in the lower range than TurboTax. H&R Block has the more features for less money than any other tax software.

TURBOTAX HOME AND BUSINESS 2016 PRICE SOFTWARE

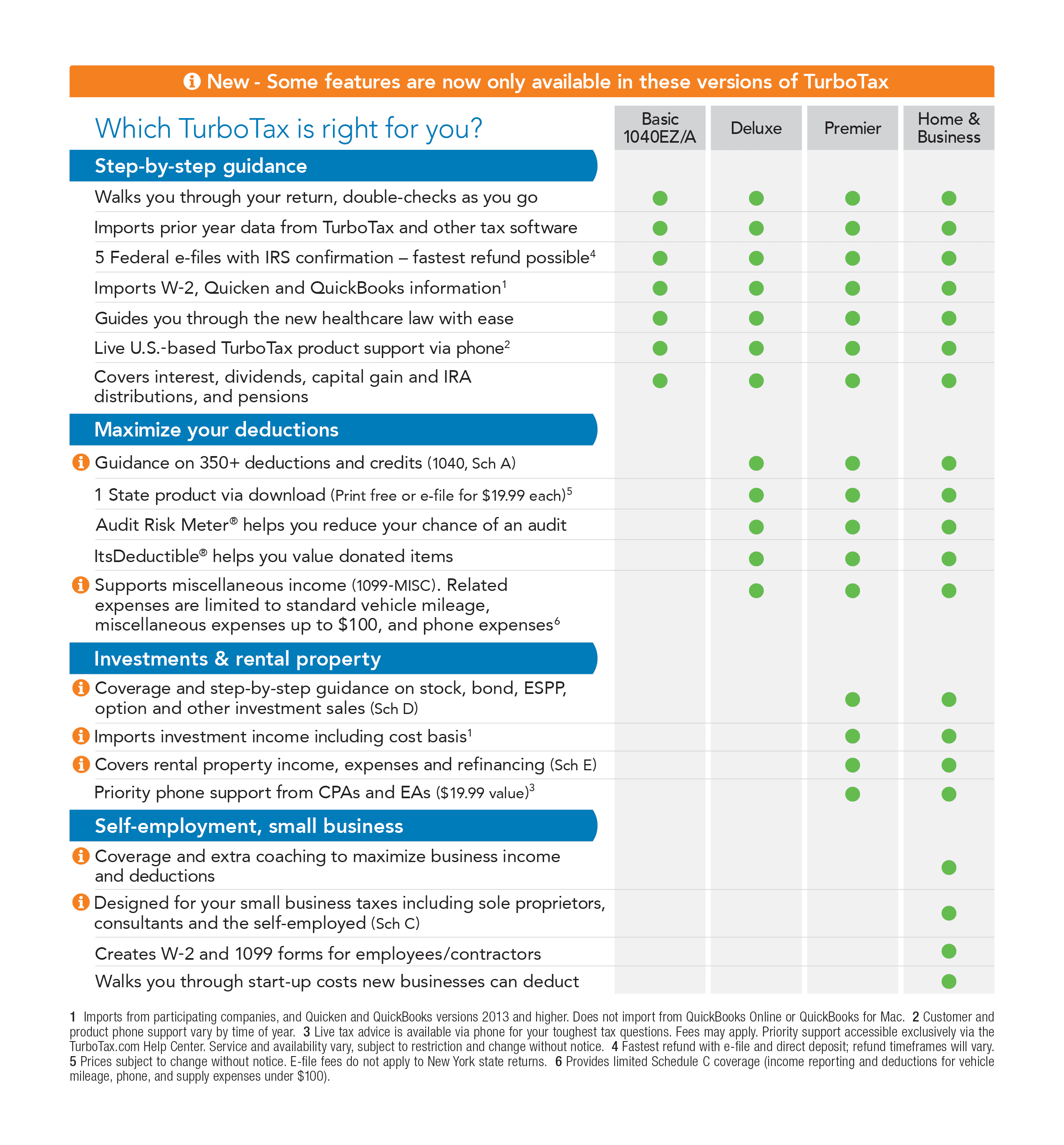

TurboTax vs H&R Block: Why H&R Block is the best tax software 2015/2016: TurboTax’s pricing scheme makes it look like the TurboTax vs H&R Block prices are identical, but that’s not the case at all. That said, taxpayers who want the best tax software at the lowest price ranges should go with H&R Block. For all around ease of use, TurboTax wins. In the TurboTax vs H&R Block comparison, it’s important to realize both are excellent products. TurboTax vs H&R Block vs TaxACTīased on price and features, the best tax software for 2016 is H&R Block. TaxACT brings the lowest price, though users sacrifice features and ease-of-use. If money were no object, most people would choose TurboTax since it’s easiest and fastest. H&R Block offers more features at lower prices than TurboTax. TaxACT brings up the rear. The tables below show side by side comparisons of all rates and features for the different tax software options. Overall for 20, the TurboTax vs H&R Block matchup puts H&R Block on top. We also match the best tax software to each specific tax need. Our picks are based on features and price.

This article compares TurboTax vs H&R Block and TaxACT to find the best tax software available. That said, the best tax software depends heavily on who’s using it. The FTC said it will continue pursuing that case before an in-house administrative law judge.In the TurboTax vs H&R Block contest, the best tax software isn’t necessarily TurboTax.

Federal Trade Commission (FTC) case over its ads, making that case "entirely unnecessary." Intuit General Counsel Kerry McLean said the accord also addresses claims in a U.S. The Mountain View, California-based company admitted no wrongdoing and expects "minimal" impact to its business. Intuit expects to record a $141 million charge for the settlement in its quarter ended April 30. New York and Tennessee led the state probe. "Today, every state in the nation is holding Intuit accountable." "For years, Intuit misled the most vulnerable among us to make a profit," New York Attorney General Letitia James said in a statement.

TURBOTAX HOME AND BUSINESS 2016 PRICE FREE

Intuit withdrew from the IRS Free File program last July. The states said that beginning in 2016, Intuit steered customers eligible for IRS Free File into using TurboTax Free Edition, only to later tell them they needed to pay $59.99 or more to file because their returns were not simple. Intuit offers two free versions of TurboTax: an IRS Free File version meant for lower-income people and military personnel, and a commercial product called TurboTax Free Edition for people with "simple" returns. online tax preparer to suspend ads containing slogans such as "TurboTax Free is free. The settlement also calls for the largest U.S.

TURBOTAX HOME AND BUSINESS 2016 PRICE FOR FREE

Wednesday's settlement resolves claims that Intuit steered at least 4.4 million customers, many with low incomes, into buying its tax preparation products despite their being eligible for free electronic filing through the Internal Revenue Service (IRS). states and Washington, D.C., that it tricked millions of customers into buying online TurboTax products that the company deceptively advertised as "free." NEW YORK (Reuters) -Intuit Inc agreed to pay $141 million in restitution to settle claims by all 50 U.S.

0 kommentar(er)

0 kommentar(er)